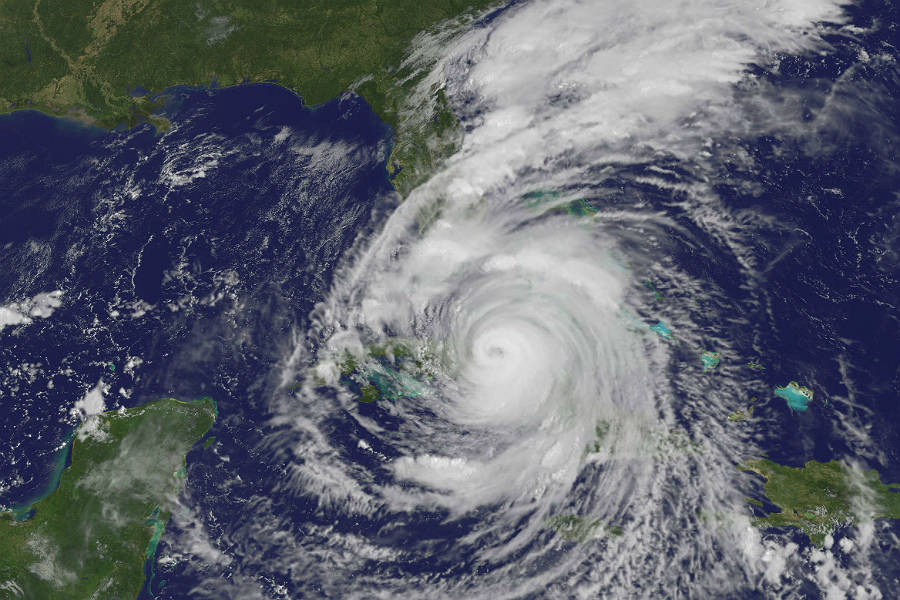

We hope that you and your families were able to stay safe during the storm. Our hearts go out to those who have been displaced or are unable to currently return to their homes because of damage left by the storm. The IRS has granted relief to the victims of Hurricane Irma to help minimize any additional penalties those impacted would recognize started on Sept. 4, 2017 in Florida.

The relief includes:

- An extension on business returns due Sept. 15, 2017 until Jan. 31, 2018

- An extension on individual tax returns due Oct. 16, 2017 until Jan. 31, 2018

- An extension on individual estimated tax payments due Sept. 15, 2017 and Jan. 15, 2018 until Jan. 31, 2018

- The IRS will waive late-deposit penalties for federal payroll and excise tax deposits due during the first 15 days of the disaster period.

- an extension of time for all individual and business returns due over the next month until Jan. 31, 2018 as well as estimated tax payments.

- The IRS will work with taxpayers who live outside the disaster area, but whose records necessary to meet a deadline occurring during the postponement period are located in the affected area.

The entire state of Florida has been affected.